My post on Sunday about SEC vs. Big 10 football produced quite a stir. There are 165 comments and counting, and it even prompted posts by Richard Longworth and Crain’s Cleveland Business.

Not everyone was critical but the ones that were basically say that it’s ludicrous to say that football proves anything. I don’t think that it does. But I will make three points:

1. The differing fortunes of the two conference is yet another in an extremely long series of data points and episodes that demonstrate a shift in demographic, economic, and cultural vitality to the South.

2. Sports is one of the many areas in which Midwestern states have clung to traditional approaches, even though those approaches haven’t been producing results.

3. Demographic and economic changes have consequences. It’s not realistic to expect that the Midwest’s excellent institutions will necessarily be able to retain excellence when supported by hollowed out economies.

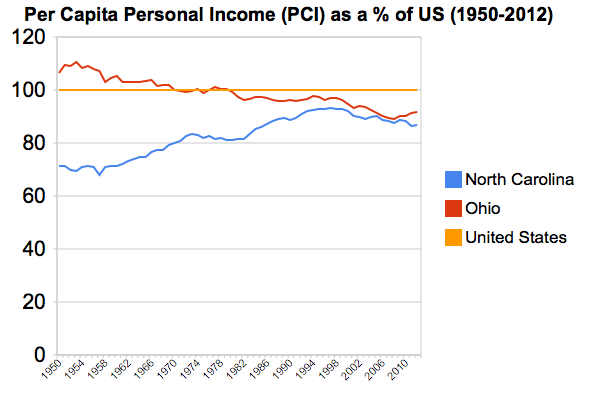

I’d like to throw up a couple of charts to illustrate the longer term trends at work. The first is a comparison of per capita personal income as a percent of the US average for Illinois vs. Georgia since 1950:

These charts show the convergence in incomes over time. The decline in relative income of the Midwest is possibly in part to increases elsewhere, not internal dynamics. But think about what the Midwest looked like in 1950, 60, or 70 vs the South, then think about it today and it’s night and day. The Midwest may still be endowed with better educational and cultural institutions than the South, but we can see where the trends are going. Keep in mind that those things are lagging indicators. Chicago didn’t get classy until after it got rich, for example.

Now we see that Southern income performance hasn’t been great since the mid to late 90s. This is a problem for them. As is their dependence on growth itself in their communities. I won’t claim that the South is trouble free or will necessarily thrive over the long haul. But they seem to have a clearer sense of identity, where they want to go, and what their deficiencies are than most Midwestern places.

Longworth seems to buy the decline theory but has a different explanation of the source, namely that Chicago has sucked the life out of other Midwestern states:

In the global economy, sheer size is a great big magnet, drawing in the resources and people from the surrounding region. We see this in the exploding cities of China, India and South America. We see it in Europe, where London booms while the rest of England slowly rots.

And we see it in the Midwest where, as the urbanologist Richard Florida has written, Chicago has simply sucked the life — the finance, the business services, the investment, especially the best young people — out of the rest of the Midwest.

To any young person in Nashville or Charlotte, the home town offers plenty of opportunities for work and a good life. To any young person stuck in post-industrial Cleveland or Detroit, it’s only logical to decamp to Chicago, rather than to stay home and try to build something in the wreckage of a vanished economy.

This seems to be a common view (see another example), even in the places that would be on the victim side of the equation. But I’ve never seen strong data that suggests this is actually the case. Are college grads and young people getting sucked out of the rest of the Midwest into Chicago?

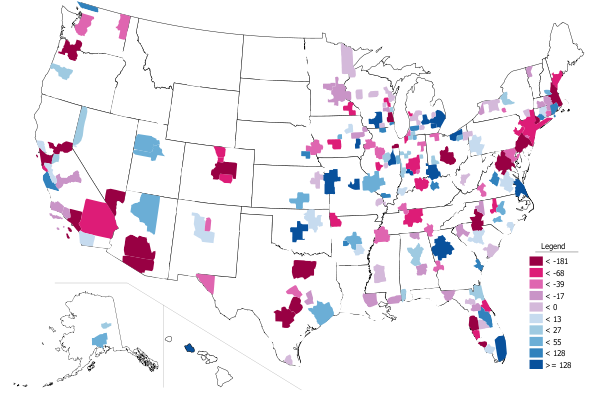

Thanks to the Census Bureau, we now have a view, albeit limited, into this. The American Community Survey releases county to county migration patterns off of their five year surveys sliced by attribute. There seems to be some statistical noise in these, and for various reasons I can’t track state to metro migrations, but thanks to my Telestrian tool, I was able to aggregate this to at least get metro to metro migration. So here is a map of migration of adults with college degrees for the Chicago metro area from the 2007-2011 ACS:

Net migration of adults 25+ with a bachelors degree or higher with the Chicago metropolitan area. Source: 2007-2011 ACS county to county migration data with aggregation and mapping by Telestrian

Net migration of 18-34yos with the Chicago metropolitan area. Source: 2006-2010 ACS county to county migration data with aggregation and mapping by Telestrian

I do find it interesting that there’s a strong draw from Michigan. Clearly Michigan has taken a decade plus long beating. There’s been strong net out-migration from Michigan to many other Midwestern cities during that time frame, and its the same in Cleveland, which also took an economic beating in the last decade. This is just an impression so I don’t want to overstate, but it seems to me that a disproportionate number of the stories about brain drain to Chicago give examples from Michigan. Longworth uses the examples of Detroit and Cleveland. These would appear to be the places where the argument has been truly legitimate, but that doesn’t mean you can extrapolate generally from there.

What’s more, even if a young person with a college degree does move to Chicago from somewhere else, will they stay there long term? They may circulate out back to where they came from or somewhere else after absorbing skills and experience. It’s the same with New York, DC, SF, etc. I’ve said these places should be viewed as human capital refineries, much like universities. That’s not a bad thing at all. In fact, it’s a big plus for everybody all around. Chicago is doing fine there. But it’s a more complex talent dynamic than is generally presented, a presentation that does not seem to be backed up by the data in any case.

I’ll chime in with my typical “anti-Detroit” Detroiter perspective on Michigan’s brain drain. It’s true that there is real, tangible positive momentum in Detroit. The urban core has improved a lot. That said, the question someone from Metro Detroit has to ask themselves is: do I want to wait a decade for Belle Isle to really turn around? Or should I just move to a city that already has tons of quality urban assets while I’m still young?

Plus, the permanency of what’s happening in Detroit is far from assured. The last recession really hit Detroit’s core hard. It was like someone hit a reset button on all the progress. If one of the Big 3 stumbles in the next 5-10 years, or Quicken Loans contracts, you could lose a lot of hard work in the blink of an eye. When you look at what’s happening with GM, you have to wonder. Cadillac just decamped for NYC!

Of course, if you don’t want to move from home, it’s true that Detroit is an interesting, dynamic place to live. But it’s a completely different kind of “interesting” than living in a premier big city.

But here’s a REAL question: how in the heck is Toledo draining people from Chicago? Now that’s a mystery!

Thanks for the look through the rear view mirror.

I think few people here are not aware of this decline. The question is is this trend slowing or reversing. Most of us on the ground have seen a huge transformation at least in the urban cores and in cultural attitudes towards urbanism since 2008.

You have also conveniently shifted the subject again. Your first post pretty clearly implied that the South was not only crushing The Midwest- but everyone. Now you put up charts that only match it against the Midwest.

If these cities are becoming world class-(And I think some, may be) they should be compared to every other region.

The real trend seems to be one of convergence.

I thought the show Mad Men did a good job of showing the transition of power in ’60s America from blustery old urban cities to cities to like Los Angeles. In fact, Don Draper – star of the show – once describes LA as “Detroit with palm trees.” Which is a pretty accurate description. The warm weather locales are having their moment as the decentralization of transportation has allowed people to basically live wherever they want.

Of course, unlike Draper, we know that the NYC weathers the storm and reemerges at the top of its game again. But there’s no doubting that a seismic shift occurred in the country during that period.

A LOT of Kotin-esque criticism like this of Chicago says that economic vitality matters, and then looks at net migration and ignores any fine-grained analysis. Chicago lost a lot of rust-belty manufacturing people and is gaining a lot of knowledge workers.

Five of the tip fourteen zip codes for Millenials are in Chicago: http://t.co/Wh5YfRsfG4

Chicago is in this years’s #1 spot for move-ins:

http://www.chicagobusiness.com/article/20140912/BLOGS02/140919953/chicago-takes-top-spot-on-move-in-list-believe-it-or-not

And, again, Georgia has improved because it was forced to improve. The Federal government has dragged the deep South, kicking and screaming, into the modern economy. This is what we want? People couldn’t move there before because it was violent and without infrastructure. This is why Ohio and Virginia and California filled up with people. Now that parts of the South has largely been reformed, why *wouldn’t* people more there? This was the explicit goal of reformation. This is catch-up growth. And it’s long overdue. It’s *exactly* like saying America is getting “beat” by China.

Also, isn’t the Illinois v Georgia comparison a little convenient? The heart of America’s manufacturing base (we know what’s happening to manufacturing jobs) compared to the South’s only coastal aerotropolis? Why not compare Minnesota and Mississippi? Iowa and Alabama? Indiana and Louisiana? In my experience, nearly 100% of the time when people with the time, means, predisposition and expertise to mount a rebuttal come up with only cherry-picked data, the reality doesn’t match what they’re trying to prove.

You haven’t noticed the pretty rapid decline of LA as an economic power? NYC did end back on top in Media- and Houston and Dallas did an OK job attracting LA’s old manufacturing base.

Even Kotkin has to admit, weather is not a big attraction for Houston. Some immigrants, Southeast Asians and West Africans from hot climates like it.

People with a long view might take the decline of Southern California as a cautionary tale but Aaron moves to whatever stock has temporary buzz.

“the decentralization of transportation has allowed people to basically live wherever they want.”

Who pays the price for all this wasteful socialist infrastructure?

I think saying LA is in “rapid decline” is more than a bit overstated. It’s still growing. Just as NYC experienced, it can’t stay red hot forever. It’s going to have fluctuations, ups and downs like anywhere else.

Let me put it this way: We all know LA is no Pittsburgh, but it’s still LA.

And with that, I exit stage left.

Considering the case being made, that great weather = growth, LA is in decline and losing ground to some places with horrible weather.

You’re talking about the rise of the South, but both Georgia and North Carolina have declining per capita incomes as percentages of the US level. Georgia has had a small decline in per capita income since 2000 even in real dollars, not just as a percentage of the US. Tennessee and South Carolina have done better, but still worse than the US average. The places that are showing larger-than-average increases in per capita income either have oil (Alaska, North Dakota, Texas, Oklahoma), or are in the Northeast (New York, Rhode Island, Massachusetts), or are catching up from very low income levels (Arkansas, Mississippi, West Virginia), or are farm states (Iowa, Nebraska). Basically, the supposedly booming parts of the South aren’t.

The story that Chicago is sucking the rest of the Midwest dry isn’t seen in recent per capita income trends, either. Detroit and Indy took huge beatings, but Cleveland, Cincinnati, Columbus, Milwaukee, St. Louis, Kansas City, Louisville, and the Twin Cities have all had slightly faster per capita income growth than Chicago (all a bit below the US average).

The only truly hollowed economy in the Midwest is Michigan’s, and its flagship university is the one that has the least to worry about of all Midwestern public universities.

“The story that Chicago is sucking the rest of the Midwest dry isn’t seen in recent per capita income trends, either. Detroit and Indy took huge beatings, but Cleveland, Cincinnati, Columbus, Milwaukee, St. Louis, Kansas City, Louisville, and the Twin Cities have all had slightly faster per capita income growth than Chicago (all a bit below the US average).”

Exactly, if anything recent trends indicate The Midwest is starting to finally leverage the tech, science, engineering and creative talent it produces. I see that in Pittsburgh and Cleveland/Akron

I’d like to see a bit more fine-grained analysis than simply “Illinois versus North Carolina” for instance. The whole midwest versus south argument misses a lot of the discussions we’ve had about different parts of the midwest and why places like Cleveland and Columbus are so different, or even why Cincinnati and Dayton are so different.

In that vein, there’s several midwest-type or even rust belt cities in the south that haven’t followed the same trajectory as their more often touted neighbors, like Winston-Salem, Birmingham, Memphis, Knoxville, and even New Orleans. Conversely, midwest cities like Columbus, Indianapolis, and Minneapolis seem to have more in common with Atlanta, Charlotte, and Raleigh than they do with the other cities in their own states.

Could this be mostly attributed to newness, greenfield economics, and a lack of historical liabilities? With the south being so far behind in development until recently, they obviously had more cities that were ready to grow compared to the midwest and northeast that had already gone through their growth and maturation phases. Indeed, it seems like the major growth industry of most of the “new south” cities is growth itself, i.e. sprawl building. The same can be said for the growing midwest cities too, or at least they seem to have a similar dynamic.

Cincinnati and Detroit really stand out in their ability to retain and/or attract graduates over 25 considering their geographic proximity to Chicago. What explains this?

The data on economic performance and migration is interesting. My experience having moved about the country a fair number of times suggests comparing the answers to the following question would also be intriguing.

Do you think [your city’s] best days are ahead of it or behind it?

Even in Detroit, where a lot of folks are bullish on a comeback, no one really seems to believe the city will recapture what it once was. And growing up in St. Louis, we never failed to hear about what a mighty city we once were. I lost count of the 1904 World’s Fair references: they invented the ice cream cone! We hosted the Olympics! We sure were something back then. But only the Cardinals embody that legacy today, and with the rise of the NFL, even baseball has begun to look like a bit of an anachronism.

Whether that represents a uniquely Midwestern mindset, I’m not sure, but it contrasts with places like DC, Denver and Seattle, where the focus is unquestionably on the future. These are cities that ask for the power of imagination, not recollection, and their current trajectories reflect that.

Jeffrey: actually, per capita income trends show the exact opposite of what you say about the Southern Rust Belt. Birmingham has had the same per capita income growth as the rest of the US. New Orleans has had a large increase, but that comes entirely from economically cleansing (in analogy with ethnic cleansing) its poor population in Katrina. Memphis and the Triad posted large declines, but overall, the non-flashy parts of the South – Mississippi and Arkansas, and to a lesser extent Alabama – had above-average per capita income growth. Jackson went from 81.7% of the US average in 2000 to 88.5% in 2012.

In the Midwest, Indianapolis was the third biggest loser of all million-plus metros, after Detroit and Grand Rapids. And between Atlanta, Charlotte, and Raleigh, there’s one metro area that had zero per capita income growth from 2000 to 2012 (Charlotte) and two that had negative growth.

John: I wouldn’t lump Cleveland and Pittsburgh together. Pittsburgh’s had strong growth; Cleveland’s had the same just-below-average growth as the rest of the Midwest. Though, I presume you can split Cleveland into two, one part that’s auto-dominated that went down like Detroit and Indy, and one that’s generally industrial and rebounding like Pittsburgh?

Matthew, maybe I was unclear on the graphic but it’s actually the opposite. The blue indicates people who are net exporters to Chicago. The numbers are from Chicago’s perspective, with positives (blues) indicating net attraction and negatives (reds) indicating net losses. In any case, the numbers aren’t huge and are subject to statistical noise.

“I’d like to see a bit more fine-grained analysis than simply “Illinois versus North Carolina” for instance. The whole midwest versus south argument misses a lot of the discussions we’ve had about different parts of the midwest and why places like Cleveland and Columbus are so different, or even why Cincinnati and Dayton are so different.

In that vein, there’s several midwest-type or even rust belt cities in the south that haven’t followed the same trajectory as their more often touted neighbors, like Winston-Salem, Birmingham, Memphis, Knoxville, and even New Orleans. Conversely, midwest cities like Columbus, Indianapolis, and Minneapolis seem to have more in common with Atlanta, Charlotte, and Raleigh than they do with the other cities in their own states.”

You came to the wrong place for fined grained or up to date analysis but you have picked up the self evident trend. Areas (like Columbus) without a major- especially heavy industrial history are mostly moving way ahead of damaged Rust Belt cities.

The situation is more complex- Pittsburgh has been becoming an ed/med and regional corporate center since the late 1800’s as the biggest steel plants grew outside the city. (Homestead, Braddock, Mckeesport, Aliquippa, Ambridge, Monessen, Donora etc)

A Mid South/ Southern Midwest axis is probably growing into a new mega region. (Nashville, Louisille, Lexington, Cincinnati, Indianapolis, Columbus etc)

But looking at complexity isn’t exactly Aaron’s thing

I think most readers of this site will be removed from the blue collar demographic where a majority of the Southern migration is occuring, and I think this part that focuses on bachelor degree movement misses that too. Most Midwestern cities are actually increasing their percentage of college educated adults, for the most part it’s everybody else that’s leaving for better opportunities.

This shift is still ongoing. I’ve read in the last few weeks of several blue collar factory layoffs around Cleveland (Nestlé, Graftech, and Republic Steel to name three) even while white collar firms like Progressive announce new hires. So I think the low per capita income gains the South sees despite all the job activity is an indicator of this trade for lower paying low skill jobs from the higher paying jobs in the factories that were lost.

That said, the activity itself is helping make the South a more attractive market for companies, this week we’ve also seen Stone Brewing choose Richmond over Columbus in relatively similar bids for an Eastern distribution facility. I wonder if these cities have been to burned by their losses over the last decade to really try to woo the grunt work. I think in some ways the Midwest may be concentrating too much on the elite job market that they’ve missing out on a lot of bread and butter opportunities.

What’s kind of funny about the posted trend graphs for Georgia/Illinois and Ohio/North Carolina is that, in both cases, the Midwest states, even after decades of “decline”, the Southern states have not surpassed them. More importantly, the trends seem to be heading in the opposite direction for all the hype. In the Illinois/Georgia graph, Illinois has clearly stabilized, and Georgia has fallen off of from its high. The gap between those states on per-capita income is actually wider now than it was in the late 1990s/early 2000s, the opposite of what one would think when the claims of the South crushing the Midwest.

With the Ohio/NC graph, North Carolina obviously peaked in the mid-1990s and has been on a general downward trend since. Ohio declined as well through the mid-2000s, but has been going up since, also widening the gap that used to be closer. Again, the opposite of what the claims would indicate.

The problem with grandstanding about the success of the South relative to the Midwest is that the data has to support that that’s really the case. If a state like North Carolina, which has been touted for a few decades now as this booming state economically and by population, shouldn’t it actually be doing better than a state like Ohio, which has been claimed for decades to be in a perpetual state of decline? Instead, NC remains economically much weaker in GDP, lower in per-capita income and even higher in unemployment. Where’s the success?

“Considering the case being made, that great weather = growth, LA is in decline and losing ground to some places with horrible weather.”

How is LA in decline? It went through a rough patch during the recession, but so did most of the country. It’s doing OK now.

With a metro population of about 13 million, LA has reached a relative saturation point. It has much larger population than Chicagoland and looks to stay that way for the conceivable future.

Your growth argument is reminiscent of exurban counties that brag about having the highest growth rate in the state. I mean, Bismark, North Dakota is killing it this decade if you look at population growth by percentages. But it only gained 9,000 people.

Again, I know LA is no Pittsburgh, but it’s trying.

It reached a relative saturation point largely due to the sprawl type policies Aaron is applauding in Houston.

Imagine if it was a dense NYC type city or a collection of dense rail connected communities surrounded by beauty instead of what it became?

It is really no longer a strong leader in any major sector- media, film, music, tech, aeropspace/defense. Yes, it still attracts people better weather and relative cheapness relative to NYC and has a thriving immigrant economy.

A few years ago, Kotkin was pushing the LA/Orange County area as the opportunity region

LA also gets a huge boost by being close to Silicon Valley. Without it, who knows where it would be.

Pre-2008, I think Kotkin was pushing the Inland Empire areas in Riverside and San Bernardino County (e.g. drive till you qualify) moreso than LA/Orange County. OC is somewhat ossified like Long Island.

Exactly, Kotkin was pushing Riverside/ Inland Empire. How did that work out? I used LA/Orange County as shorthand for the region but you are right.

I can’t believe Aaron doesn’t know this which is why his willful ignorance gets on my nerves.

“What’s kind of funny about the posted trend graphs for Georgia/Illinois and Ohio/North Carolina is that, in both cases, the Midwest states, even after decades of “decline”, the Southern states have not surpassed them. More importantly, the trends seem to be heading in the opposite direction for all the hype. In the Illinois/Georgia graph, Illinois has clearly stabilized, and Georgia has fallen off of from its high. The gap between those states on per-capita income is actually wider now than it was in the late 1990s/early 2000s, the opposite of what one would think when the claims of the South crushing the Midwest.”

Don’t use logic when Aaron has a point to prove.

Look the south was a economic and social backwater for 100 years after the Civil War, I’m not sure why it would be a surprise for parts of it to catch up with the rest of the US.

John M: “It reached a relative saturation point largely due to the sprawl type policies Aaron is applauding in Houston.”

There is only one Midwest big city denser than LA, and LA has been increasing in density. Look, I’m not here to defend LA or sprawl, but to point out reality. The Midwest sprawls as bad as anywhere and quite a few of its urban cores are ravaged.

If people want true urban living, they typically move to the coasts. Your whole idea that the Midwest has some ace in the whole with its grids just isn’t true. The coasts already have great urban environments. Who cares about a hollowed out grid in Indiana or Ohio?

i think for the framing of this discussion, ie Big Ten vs Sec, we can look at the time after the ’99 ‘to ’01, when three Teams in the Big Ten won three National Championships. After that, Georgia ‘s per capita income has fallen relative to Illinois. I don’t think this proves anything, but it’s the opposite of what Aarron wants us to see. Kotkin would approve.

Here’s a great stat:

City of Chicago had 642,984 people with a bachelors or higher in 2013 vs. 623,484 in 2012.

City of Atlanta had 123,776 people with a bachelors or higher in 2013 vs. 125,149 in 2012.

In 2007 Chicago had 525,297 people with Bachelors degrees or higher, growth rate of 22.4% from 2007 to 2013.

In 2007 Atlanta had 116,033 people with Bachelors degrees or higher, growth rate of 6.7% from 2007 to 2013.

Its true that LA is getting much denser- but I question if it is happening fast enough. Housing is still quite expensive, taxes are very high and the region is undermined by massive legacy costs- underfunded pensions and failing infrastructure.

It also is slower to turn away from anti urban policies like parking minimums than towns like Nashville and Atlanta.

The big trend among millennials is migration towards low cost places. (Houston’s big edge) Many are burdened with huge college debts and saw their parents get smashed in the housing bubble. A highly skilled minority is still willing to chase fortune in high cost areas if you pay them enough.

If you believe millenials and all subsequent generations are destined to be broke forever, then it stands to reason that eventually high cost locales will be forced to lower rents to a commensurate degree. In 30 years we’ll be reading about how Joe & Jane Millenial could’ve never dreamed of living in NYC when they were young, but now that the baby boomers are gone and generation X is in the retirement home, rents have decreased precipitously.

When I was in college in the late 1980s I went home with a friend of mine to Cleveland for a long weekend. I had never been to Cleveland. My friend was from a nice western suburb of the city. After we had toured around the city for the day I had a conversation with her mother about the Cleveland. It was devastated. It probably looked more devastated then that it does now. I still remember the sadness in her voice when she said “Cleveland used to be great…”. There was a clear sense that it was over forever. Things had changed. That was in 1988.

You are pointing to problems that have been known about since the 1980s at least. I’m not sure why you are suddenly beating up on the Midwest AGAIN for so many of the problems it has. Millions of people have lost good paying jobs. Those aren’t coming back and we know it. There was economic warfare and the Rust Belt lost. The winners of that war offered no help. Those people that lost jobs had to do SOMETHING. Some couldn’t afford to go anywhere and are stuck in place in poverty. Others have managed to move on to California, Texas, Virginia, North Carolina and of course Florida. We know that.

Others have stayed behind to try to and build something new. That takes time where there is so much damage to be undone. It will take generations. How long will it take to fix all of Detroit, if ever? 100 years? More? Or the South Side of Chicago? or east Cleveland? Those are massive areas. They lost an economic war and there is no post-war reconstruction effort except for what those areas are able to pull together on their own. There is little outside help, if any. What there is from the outside is a lot of schadenfreude. I’m frankly amazed at how much has been accomplished in just a few decades.

What would be helpful is to start a discussion about what the Midwest can do to keep turning things around. I would have focused on different things, but I can understand why Clevelanders hurt pride led them to spend money on stadiums when they should been focusing on other things. They are getting there bit by bit. What should they do next?

As a footnote, If you look at the unemployment rate for large metros, Atlanta is second from the bottom and Charlotte, Tampa and Memphis are right down there with it. Minneapolis, Columbus, Cincinnati and Indianapolis are all among the 10 best. Minneapolis is number 1 and Columbus is 2 (those cities have a lot in common). Even Chicago is in the middle of the pack.

http://www.bls.gov/web/metro/laulrgma.htm

The real strength of cities like Indianapolis, IMO, is that it gives new parents that used to live in big urban cities that chance to live somewhere cheaper and semi-suburban (if we’re talking about the inner city) that still retains a bit of an edge and cachet. This demographic doesn’t want to raise their kid in a sketchy Brooklyn neighborhood, but doesn’t want to move to an NYC suburb, either.

Kind of strange that people are accusing Aaron of cherry-picking when his Southern examples are the two worst-performing states in the South. Atlanta’s per capita income has declined at the same rate as Detroit’s since 2000. In 2000, it was richer than the rest of US; it is now significantly poorer. The parts of the South that are doing well are the ones that hadn’t caught up to Northern incomes and are continuing their catchup process now, like Jackson.

I mean, the story of “the exciting parts of the South have declining incomes whereas the ones Northerners think are irredeemable have rising incomes” is very different from “the South is rising and the Midwest is sinking,” but it’s also very different from “the Midwest is already rebounding and the South is declining again.” The only parts of the Midwest that have above-US-average per capita income growth are the rural Great Plains ones.

Yes Alon the Plains are doing well, especially the areas with oil. Texas is doing well too in large part because of oil. With oil prices and futures on the decline we will see if that can continue.

We are finally getting to back to reality. If I still lived in NYC, I would be paying about 3000 to live in sketchy neighborhood with poor transit service and possibly facing eviction.

I knew people who “squatted” in an illegal loft for $3000-4000 a month and faced the constant threat of eviction.

http://gowanuslounge.blogspot.com/2008/01/dispatches-from-frigid-mass-eviction-at.html

Since that time things have only gotten worse and much more shaky areas areas much further into Brooklyn are facing the same issues.

Everything has a price. If I won more than $25 million in the lottery I would consider going back.

When I walk tour Brooklyn art studios now, I don’t hear about people expecting or wanting to stay. Have fun, do work for a year or two- try to hit the big time and leave is the current dream.

John M.: “We are finally getting to back to reality.”

Sort of. But I’m not convinced the Midwest’s strengths have it poised to attract tech entrepreneurs and other important creative class workers. In a postindustrial America, that’s a significant issue (I know some aren’t fond of the current economic makeup of America, but right now it is what it is and you have to work with that).

If anything, the Midwest looks like it’ll continue to slump along as the country’s frumpy relative.

Regarding the per-capita figures, I think it reflects that a lot of low/medium-skill work is locating in the Southern states (especially GA, SC, NC and western TN). There is also a reasonable growth in higher-skill work, but not an extraordinary amount. The net impact is a combination of (1) rapid population and job growth and (2) mediocre per capita productivity/income figures, mitigated by a low cost of living.

In contrast, many Midwestern cities are losing their low/medium-skill work but doing a better job of holding onto their higher-skill work (such as engineers). The net impact of this is (1) stagnant job and population figures and (2) good per capita productivity/income figures, especially when combined with generally attractive costs of living.

The Midwest in the 50s was a blue-collar paradise, and the loss of that has left deep scars, but the area is doing well on a per-capita basis. Of course, part of the reason is that many lower-skilled workers have moved to the South, making per-capita figures look good in the Midwest.

An extreme example of this is seen in cities like SF/Silicon Valley and Boston, where even the middle class is being driven out. It makes per capita income figures look great (low/mid-skilled workers are leaving), but the cost of living is punishing. Silicon Valley was the biggest center of semiconductor manufacturing in the US through the mid-90s; ever since it has been TX. Of course, plenty of chip design engineers still work in CA, but the lower-wage technical workers (many of whom “only” earn $50-100k/yr) have been driven out.

George, what’s so special about low-cost semi-suburban living? That exists everywhere in the US outside the largest metro areas.

To be honest, this entire discussion of Indy and similar-size US cities cracks me up. I live in a city with the same population as Indy (both city proper and metro area). The population growth here is somewhat higher, but I don’t know how high – all I know is that Sweden is a bit ahead of the US nowadays, and Stockholm is growing faster than the rest of Sweden because, despite the housing costs, there are more and higher-paying jobs here. Europe still lags the US in incomes, so the average salary (net of rent and interest), already one of the highest in Europe, is about the same as in Chicago, and behind the really rich US cities like Washington*. The central parts of the city are walkable enough that upper middle-class professors bike to work and don’t own cars. The city has a subway and a commuter rail system with about 1.3 million daily riders between them; this does not exist in North America – per capita, this is well ahead of New York, let alone Indy, Portland, Charlotte, and other US cities of this size class, where people applaud a light rail line that gets 50,000 daily riders as visionary.

This, to me, is a lot more important than trying to slice urban demographics by creative class, working class, entrepreneurs, or whatever political buzzwords are most in vogue. In terms of providing services to residents, the gap between Indy and Stockholm is vast, and most of this is about national or regional rather than urban characteristics. Stockholm isn’t unique in Europe, and Indy isn’t unique in the US. It’s not even a matter of competition – there were periods in its history when Indy could have decided to buck the trend and become more urban rather than suburban, for example when it enacted Unigov. But then, the US was sure the entire world wanted to and soon would look like it. A handful of cities, like Portland, hesitated in the trend and also built a bit of light rail. None really bucked the US-wide trends of urban renewal, suburban zoning, auto-oriented transportation policy, and disinvestment in the urban core. (I’d also add segregation to this list, but Stockholm isn’t any better on this, it just isolates poor people in the suburbs rather than in the inner city.)

*Eurostat reports GDP per capita (inappropriate for metro area) and per capita income net of rent and interest, but not gross per capita income. Fortunately, the BEA does report the latter figure: go here, click on Economic Profiles (CA30), and then choose the statistic “per capita net earnings.” Beyond that, you just need to PPP-convert euros and dollars; Eurostat already PPP-converts based on national living costs, so you just need to know the correct dollar conversion rate. As far as I can tell from looking at how income figures change between the PPP-converted and the nominal table, I think they’re deflating to the EU-wide average and not the eurozone average, and the correct figure is about 1 EUR = 1.3 USD.

@George V

The Midwest is particularly well suited to certain types of tech that either people don’t use everyday (aerospace, logistics and biomed) or that they do use everyday but don’t think of as tech (3M, P&G, Archer Daniels). We’re not likely going to see the next Zynga or Facebook come out of the region, but that doesn’t mean the region is light on R&D that will be beneficial and profitable in the next 50 years.

Derek, I no longer have access to Telestrian, but when I did, I actually looked at the theory that there was a mass working-class exodus from the coasts to the Sunbelt. I specifically looked at the effects of migration on per capita state income in New York, California, and Texas. The result was that this trend did exist last decade, but was weak, raising New York and California’s per capita income over the decade by about 1% and lowering Texas’s by same.

@ Alon: “George, what’s so special about low-cost semi-suburban living? That exists everywhere in the US outside the largest metro areas.”

I agree that’s it not that special. Yet it is, unfortunately, the Midwest’s only real card to play (outside of Chicago). Many middle class American urban citizens don’t want to raise their kids in the big city, and Indy, Des Moines, and etc. fit the niche they’re looking for.

@ Kendall A: “The Midwest is particularly well suited to certain types of tech that either people don’t use everyday (aerospace, logistics and biomed) or that they do use everyday but don’t think of as tech (3M, P&G, Archer Daniels). We’re not likely going to see the next Zynga or Facebook come out of the region, but that doesn’t mean the region is light on R&D that will be beneficial and profitable in the next 50 years.”

I agree in that the Midwest isn’t about to fall of the face of the planet. People will continue living and working in the Midwest, but it’s never going to get close to recapturing its former glory. The region pissed that away by sprawling way more than its economy and population could support. Say what you want about the sprawl in the South, but at least the population was growing significantly at the time.

Also: I know no one likes to hear a negative Nancy declaring that the Midwest’s best days are permanently behind it. But I think it’s an important message, because one of the biggest problems plaguing the Midwest is that it still thinks too much like a boomtown. I can’t even begin to tell you how much money has been spent in Metro Detroit over the decades to support “growth” that was occurring, and yet the population level has essentially been stagnant since 1970.

The costs of that are really hurting the region now. Detroit is bankrupt. There’s not enough money to maintain vital roads and infrastructure throughout the metropolitan area. The resulting problems are huge.

Regarding per capita incomes, I have flagged Atlanta as a laggard for years now in various writings. I picked average Southern states rather than cherry picking the best stats out of say Houston.

The per capita income numbers are interesting because with a couple exceptions like Washington and Houston, per capita GDP declines vs. the US are associated with growth in population and jobs. The Bay Area is scorching it in GDP and income per capita, but has actually lost jobs in 2000. Building an elitist economy is not something I’d consider real success. Lots of exclusive suburbs could make the same claim.

I don’t know all the dynamics, but would guess that since we’ve generated huge numbers of low wage and temp jobs in recent years, places lie Charlotte, Indy, etc. are attracting a disproportionate share of those jobs and thus the people to fill them. This would pull down averages quite apart from the incomes of the existing base. Also, the Midwest growth stories are absorbing a lot of “capita” from their hinterlands.

Some of the very recent changes are likely due to cyclical effects. Manufacturing is pro-cyclical, and the Midwest is known to lead into and out of recessions. There was also extensive pent up auto demand and major bailout funds to Detroit. No surprise we saw an uptick there. Historically these cyclical upswings haven’t proven sustainable.

Also, we need to look at the makeup of the “capita”. The top five metros for the percentage of their population that is working age includes Seattle, San Francisco, Washington, and Boston. (Austin, a per capita GDP loser, is actually #1 for working age population share, but I wonder if students affect the results?)

Conversely, slow growth Rust Belt cities, family magnets, and retirements zones have lots of children and seniors that mostly aren’t working and thus pull down your score.

Additionally, these values should be race normalized. Overwhelmingly the predominant concentrations of black population is in the South. People clearly see the racial angle in some criticisms of “Detroit,” but abuse of Mississippi is in the same vein. MS is over 37% black – #1 in the United States. We know that America has failed utterly at inclusion of blacks into educational, economic, and other forms of success. And that’s not just in the South. If you race normalized all the metrics that supposedly make the South look bad, I wonder what the results would be? Criticizing “the South” has become one of the last acceptable ways of de facto criticizing blacks.

Alon, Indianapolis vs. Stockholm is easy to understand. The radical difference in the cities reflects the differs values of the people who live there. I think it’s fair to say that the built form and services delivered in them fairly reflect the values and culture of their people. As do many of the results that flow from them.

Which should be a warning to places like Dallas, “investments” that don’t pay off can become like a noose around your neck.

“Drivers in Dallas, across state pay price for aging highways”

http://www.dallasnews.com/news/transportation/20140723-drivers-in-dallas-across-state-pay-price-for-aging-highways.ece

“Kennedy said building wider, faster highways only creates more congestion. He said it also promotes less dense development, which suppresses economic and property tax potential. That practice essentially leaves the government unable to afford the infrastructure it builds by keeping revenues and expenses out of balance, he argues.

“We’re already beyond our means,” Kennedy said.”

Indy seems to always need more to pump more $$ to keep so called investments like stadiums afloat. Meanwhile Aaron warns Columbus about how it needs to repeat the same failed strategy or somehow lose out to suburbs that don’t exist.

“I think it’s fair to say that the built form and services delivered in them fairly reflect the values and culture of their people.”

Some cultures and values are likely to lead to bankruptcy. Just saying people like something doesn’t mean they can afford it.

The American preference against big cities is not something that’s in the DNA of Americans or anything like that. It’s not even in the cultural DNA. It’s a result of the lack of good urban options. There’s a minute number of dense urban neighborhoods with amenities the middle classes want: good schools, reasonable access to jobs, reasonable access to supermarkets and other staple retail, safety, quiet at night. The reason for this is not about current American values; it’s about the American power structure at the time key decisions were made in nearly all American cities in the first two thirds of last century.

Also, Aaron, you’re confusing absolute per capita income and growth in per capita income. Bay Area’s per capita income peaked in 2000; its income went down together with its number of jobs after the tech bubble burst. New York and Boston both had marginally faster per capita income growth than the US. Detroit underwent reduction in both jobs and per capita income. If you look at subperiods of 2000-12, you’ll also see that until 2007, Las Vegas and Tampa held their ground, and Miami, Orlando, and Phoenix had faster per capita income growth than the rest of the US, but the housing crash sent all five cities sharply down, in terms of both employment and per capita income.

John Morris:

Are you claiming that Sweden is heading for bankruptcy quicker than the United States? Really?

In the focus on urbanism, we cannot forget other, national issues that play into such a claim. Such as, for example, the three trillion dollars that are being dumped into various Middle Eastern and South Asian cesspools because our deluded and sociopathic ruling class thinks it can manipulate and rule the world. When, as anyone who drives around the United States and uses their eyes would agree, we cannot even run our own country.

Just saying zoning and urban planning are important. But when yiu are dealing with The Shining City on the Hill that needs to rule everything, well, that costs an awful lot of money.

Obviously I was suggesting the dominant urban policy of the United States is not sustainable. Kotkin’s previous land of plenty, The Inland Empire is almost a dustbowl now.

Aaron’s back up defense when cornered is to always say that policy reflects culture. Who are we to argue with whatever people seem to want?

Ah. Of course.

This is the argument I always have with my sister. People may “want” the suburban home and the three car garage and the cul de sac, but is it sustainable?

Especially given MY litany of error, which suggests that the United States will not be prosperous enough to sustain the suburban Megastructure. Even here in suburban California, we cannot afford to maintain very well our local streets in the endless subdivisions…but meanwhile we are starting to build a multi-billion dollar interchange to temporarily improve traffic flow!

Its pretty debatable how many people really want that. People chose from available options, within their resources. The government has decided people should want that even if they don’t.

At least a few polls show “most” people would like a house- in a walkable neighborhood near stores, parks and schools which is closer to Squirrel Hill or Lakewood, Ohio than most of Dallas.

It also is not as deep in the DNA of most places as suggested. Indy and Atlanta once had extensive streetcar suburbs.

@ Aaron:”Some of the very recent changes are likely due to cyclical effects. Manufacturing is pro-cyclical, and the Midwest is known to lead into and out of recessions.”

Aaron, you’re not still buying that garbage, are you? Manufacturing has been on an overall downward trend for quite some time. Yes, it’s still cyclical, but there’s no denying that at the end of the day (or decades, in this case) it’s contracting. The Fed Reserve Bank of Chicago has a great chart at the end of this article that tells the real story: http://michiganeconomy.chicagofedblogs.org/?p=256 .

Manufacturing will always be a part of the Midwest economy, but it’s never going to be the major driver in its growth again unless the world economy drastically changes.

@Alon,

Sorry, but that’s just not true. Per-capita income in the Midwest is much higher than in the South, and the gap between them is widening. This is at the state level.

“it’s never going to be the major driver in its growth again unless the world economy drastically changes.”

But the world has radically changed, which probably helps explain these figures and probably the increasing tech and engineering job base in the Midwest.

Manufacturing today, overwhelmingly replaces people with automation, software and process improvements. More companies are growing in the US but the number of workers continues to shrink.

Extremely low interest rates and policies that increase labor costs have created a huge push towards automation.

This has played to Pittsburgh’s strengths in software and robotics.

Jon, okay, let’s look at the state level. Per capita income levels, as a percent of the US, in 2000 and 2013:

Illinois: 107.7 –> 105

Indiana: 91.9 –> 86.3

Iowa: 90.2 –> 100

Michigan: 98.1 –> 87.2

Minnesota: 105.7 –> 106.1

Missouri: 91.6 –> 90.8

Ohio: 93.6 –> 91.7

Wisconsin: 96.1 –> 96.6

—

Alabama: 80.5 –> 81.5

Arkansas: 74.5 –> 82

Florida: 96.7 –> 92.7

Georgia: 93.7 –> 84.5

Kentucky: 81.5 –> 80.9

Louisiana: 77 –> 92

Mississippi: 70.5 –> 75.8

N Carolina: 91.1 –> 86.4

Oklahoma: 81.1 –> 93.5

S Carolina: 82.1 –> 80

Tennessee: 89.8 –> 88.4

Texas: 92.7 –> 98

Virginia: 106.1 –> 109.1

W Virginia: 72.2 –> 79.4

Notice how the differences within each region – Iowa vs. Michigan, and Oklahoma vs. Georgia – are much larger than the differences between the two regions. Overall the Midwest is richer, but it’s not getting richer any further.

Aaron said: “I don’t know all the dynamics, but would guess that since we’ve generated huge numbers of low wage and temp jobs in recent years, places lie Charlotte, Indy, etc. are attracting a disproportionate share of those jobs and thus the people to fill them. This would pull down averages quite apart from the incomes of the existing base.”

John Morris said: “Some cultures and values are likely to lead to bankruptcy. Just saying people like something doesn’t mean they can afford it.”

Exactly. Chasing growth for the sake of growth. It’s such a popular philosophy, but when you’re providing incentives to bring in low wage jobs because any job growth is better than no job growth, it would appear that you’re actually hurting your city if you’re simply attracting more low wage workers who will not be able to pay the taxes necessary to provide the minimally acceptable amount of infrastructure and public services that the middle class demands. The accompanying deterioration of infrastructure and services then makes the city even less attractive to middle and upper income workers who are needed to fund local government. This sounds like the textbook example of unsustainable growth.

Bottom line is: who cares about population and job growth, if GDP and median and average incomes are decreasing? Who cares if Charlotte is growing quickly, if incomes are decreasing there, especially in comparison to the rest of the country? Of course, very few metros would be well served by losing population, but fast growth based on being an attractive place for low wage jobs is not a sustainable policy that should be trumpeted and mimicked.

And thinking about it on a national level, isn’t it actually a net negative for the country to be supporting so much subsidized infrastructure in places like Charlotte, Indy, or whatever city is attracting low-income jobs while we must also continue to maintain and rebuild existing infrastructure in the cities from which these high-growth cities are attracting low-wage workers? Of course, we can’t and shouldn’t restrict people’s right to move, but, considering the numerous federal tax dollars that go to infrastructure, should we rethink the policies that contribute to jobs relocating and almost forcing the people to follow?

Notice how Aaron wants to have it both ways. He says low per capita income growth in a place like Houston is OK because the city is attracting the striving poor and working class. (Which is true)

But then he posts this:

“Brooklyn is getting poorer”

http://www.urbanophile.com/2014/09/09/brooklyn-is-getting-poorer-by-daniel-hertz/

News item- a large parts of Brooklyn are showing the same surges in striving low income residents. (large parts are actually mired in multi-generational poverty)

Brooklyn’s Chinese Pioneers (City Magazine)

http://www.city-journal.org/2014/24_2_chinese-immigrants.html

“Over the past several decades, hundreds of thousands of mostly poor and sometimes undocumented immigrants from the Chinese province of Fujian have crammed themselves into dorm-like quarters, working brutally long hours waiting tables, washing dishes, and cleaning hotel rooms–and sending their Chinese-speaking children to the city’s elite public schools and on to various universities. The new Chinese immigrants are quietly having as great an effect on Brooklyn’s social, economic, and cultural landscape as are the borough’s hipsters and “trustafarians.” In turning a once-forgotten, now-overcrowded portion of Brooklyn into a launching ground into the middle class, they’re challenging new mayor Bill de Blasio’s portrait of New York as “a tale of two cities.””

The South is growing on four things – cheap labor, cheap land, cheap/new infrastructure and arguably better weather than the Midwest.

Cheap labor can continue as long as people keep moving South for cheap housing, the low-tax environment and the weather, but I don’t believe those attractions are sustainable. Income parity is going to be a bad, not a good thing for the cult of growth in the South.

Commercial and industrial land is just going to fill up. There will always be sprawl, but as in the Midwest they’re going to reach a limit of how far companies are willing to locate from business centers. And as in Chicago, people are going to start complaining about the environmental impact of heavy industry as housing inches closer to the smokestacks.

Everything from public infrastructure to factories is cheap now because it’s new. The bills for the roads are going to start coming due in 20-30 years, and then taxes will have to go up. Unfortunately Illinois has shown business’ ability to extract subsidies for existing facilities, but people are also getting tired of it. As we’ve seen in Detroit and Chicago, sometimes businesses want/need to build a new plant to address changing needs no matter how much you pay them to retrofit their old site.

I won’t get sanctimonious about how global warming is going to destroy the South because it’s not a good look, but it’s not going to get any less muggy down there. Plus, killer bees, fire ants, giant snails, etc.

Eventually the South is going to hit the wall, and then it’s on to somewhere else.

Harvey, you may be using a faulty mental cost model. The warmer Southern weather doesn’t tear up roads and bridges or cause subsurface disruptions to water and sewer lines like the freeze-thaw cycles in the I-70/I-80 tier. Their roads will genuinely last longer if built to the same standard.

My point is, the first cost or the lifecycle cost is lower either way, giving the Southern states a more or less permanent infrastructure cost edge.

@Alon…

You have a source for those numbers? As with the graphs Aaron posted, I suspect there are internal trends that are not being shown or acknowledge.

For example, did the Midwest states bottom out before 2000-2013, or during it? Have any of them shown rises from that bottom? And the reverse could be asked with the Southern states. Also, you’re only showing one way to measure income to begin with.

Here are a couple graphs I made using BEA data. First, per-capita regional GDP. I’ve also broken off Texas alone and the South without Texas, to show that, for the most part, the South owes quite a bit of its regional success to a single state.

http://www.chartgo.com/linkshare.do?id=257f5e32aa

And here is per-capita income.

http://www.chartgo.com/linkshare.do?id=55d8ac9faa

I know they’re a bit hard to read, but you can follow the lines anyway. Neither chart shows the Midwest losing ground vs. the South. In fact, it’s increasing its lead.

http://www.chartgo.com/linkshare.do?id=4f38c47daa

This is true despite the fact that the South had much faster income growth by percent through the 1970s. Since the 1980s, however, the two regions have largely been very close to each other, and the Midwest led during the 1990s and is leading so far in the 2010s. This tells me that the South’s greatest move upward happened quite a while ago.

@Chris Barnett

“Harvey, you may be using a faulty mental cost model. The warmer Southern weather doesn’t tear up roads and bridges or cause subsurface disruptions to water and sewer lines like the freeze-thaw cycles in the I-70/I-80 tier. Their roads will genuinely last longer if built to the same standard.”

Thanks for stating the obvious downside of sprawl in a cold wet climate with many freeze thaw cycles.

We can add the huge problems smow, ice and wind cause without buried power lines. Visitors from outside the U.S. are shocked by an unreliable almost third world power grid.

“My point is, the first cost or the lifecycle cost is lower either way, giving the Southern states a more or less permanent infrastructure cost edge.”

The generalization here is absurd. Almost all of the so called south outside of southern Texas, Florida and the Gulf coast experience some cold winter weather. Those places tend to face extreme heat and a high hurricane risk.

Even so, this does prove that building sprawl in a cold climate plays against one’s strength.

John, did you not notice the byline on the first article you linked to? It’s not by Aaron. It’s by Daniel Kay Hertz, who does not share Aaron’s general philosophy of cities; for one, he’s well to Aaron’s left, and somewhat to my left on social justice issues. He writes about issues of segregation and gentrification, and the main point of the article is to attack trend pieces in the New York Times and similar outfits that posit that Brooklyn (and by extension all of New York) is gentrifying. The Sunbelt has nothing to do with this – Daniel’s talked about it in his blog posts even less than I have in mine. He’s attacking claims that New York is becoming a playground for the rich, rather than participating in Kotkinian pissing matches over whose state is better.

Also, that City Journal article you linked to is horrific: racist model minority mythologizing (complete with “I’m not saying they’re a model minority, but” statements), gratuitous digs at gender studies majors (ha ha, they can’t get jobs, ha ha), indifference to the fact that the very journal has published nativist screeds by Mark Krikorian.

Jon, all of my numbers are from the BEA’s annual state income tables. I use per capita income and not GDP, because GDP is comically inaccurate at boundaries between cities and suburbs, and also includes corporate profits even if they go to out-of-state shareholders. I also don’t include the Plains states (KS, NE, SD, ND), which grew faster than the industrialized states and which don’t really belong in any conversation about the Midwest any more than Maryland, officially part of the South, belongs in a conversation about the South. But since the Plains states are so small, their effect on the overall regional numbers is small, so the difference ends up not very important. Notably, your third graph, the bar chart, shows that the Midwest and South have had basically the same per capita income growth since 1980, after decades in which the South was catching up to higher Midwestern incomes.

@Alon

Please- its pretty clear why Aaron posted the Hertz pieces, for the same reason he posts constant Houston rising stuff. The clear implication is somehow NYC is failing or falling off a cliff.

The point is that he celebrates Houston’s attraction of poor and working class immigrants as huge sign of success but tries to spin the same trends in NYC as a sign of failure.

For the same reason, we notice Aaron stopped making comparisons between the South and the rest of the country.

Clearly the first “SEC post” pushed the idea that the South was kicking the entire country around the block. Now he is trying to walk that claim back or ignore it.

“Now we see that Southern income performance hasn’t been great since the mid to late 90s. This is a problem for them. As is their dependence on growth itself in their communities. I won’t claim that the South is trouble free or will necessarily thrive over the long haul. ”

WHAT???!!! The first post absolutely pushed the idea that the South was destined to crush everyone.

I think Renn sees a lot of similarities between the south and Indianapolis and probably equates their trajectories together on some level, hence the need for southern dominance.

The development strategies seem to differ among the Midwestern cities. If you look at the city of Indianapolis, everything seems to be done or built cheaply with a few exceptions like the cultural trail (like parts of the south). It appears that they currently have a nice amount of infill being built around downtown but it also some of the most uninspiring and cheap buildings I have seen in an urban area in the country.

They do a good job of attracting lower income or lower middle class earners but unless things change, Indy is going to have a hard time ever attracting high income earners. In many ways it’s admirable to present opportunities for lower wage workers but it is probably not something that is sustainable. At the risk of being politically incorrect, Indy also has one of the highest homicide rates in the Midwest and unlike other Midwestern cities does not seem to be improving in this respect.

Other midwestern cities which are more stagnant seem to be chasing the high income earners to the exclusion of the lower class or even middle class. My hometown Cincinnati is attempting to gentrify the inner city by redeveloping old historic buildings into expensive condos (for Cincinnati) which is a long painstaking process. There are so many vacant buildings around the inner city that at this rate I question whether they will all ever be filled. It is gentrification similiar to what we have seen in coastal cities but Cincinnati is much smaller. Cincinnati has built its share of cheap new buildings too but the approaches of the cities seem different and it will be interesting to see the results in 30-40 years.

“I think Renn sees a lot of similarities between the south and Indianapolis and probably equates their trajectories together on some level, hence the need for southern dominance.”

Yes, but he wants to have everything both ways.

Both Nashville’s removal of parking minimums and Atlanta’s Belt Line infill boom are a departure from the old pro sprawl development he seems to love. Same with recent trends in Houston’s core.

He makes an excellent point- the San Francisco type, city as gated community of the uber wealthy and high skilled fails everyone else. We need more cities open to growth and real economic diversity.

What I don’t see is how highway socialism is a sustainable way to do that. Even many conservatives and tea party types are catching on to the weakness of this model.

“We need more cities open to growth and real economic diversity.”

Unfortunately this is difficult to achieve. The upper and middle classes generally do not like living with the lower class and never have. Lower income residents are almost always segregated into their own communities which proceed to have high crime rates and little upward mobility. Which is why you see low income per capita growth in places like Houston and high income per capita growth in places like San Francisco. Most cities are probably attracting a specific class within certain areas. Perhaps the key is to attract a diversity of incomes but who do you feel is doing that successfully now? Maybe Atlanta? It seems that they are a laggard in per capita income growth.

My take on it is that the middle class still overwhelmingly prefers the exurbs or suburbs outside city limits for reasons such as safety and schools. Most cities are either attracting a majority low income or a majority high income within city limits. (The upper class are obviously more likely to send their kids to private schools). I don’t know of any city that is attracting a significant amount of people of all incomes within their city limits.

Aaron has a real point here. Cincinnati/NKY is losing 1,600 good Toyota engineering and professional jobs to Dallas (more precisely, Plano TX) announced last summer. Our airport hub is a shell of what it once was compared to airports in cities like Charlotte to whom we lost the Chiquita company. (Although Chiquita has since announced a plan to move to Ireland so maybe no big loss there.) The Midwest absolutely cannot rest on its laurels. I think the answer in Cincinnati is to continue to apply urbanist principles and to grow the Downtown, Over the Rhine, West End, and Uptown neighborhoods to their full potential. These can serve as business incubators, hopefully for tech and services. Also, there’s already been some success with new restaurants started in our core that have recently expanded to locations in other cities. We also need as many local businesses in walkable neighborhoods as possible so we can recycle the money we do earn from the global economy many times before sending it out of town.

“Perhaps the key is to attract a diversity of incomes but who do you feel is doing that successfully now? Maybe Atlanta? It seems that they are a laggard in per capita income growth.”

NYC once did this pretty well and my on the ground impression was that Atlanta was moving in this direction. Now cities in northern New Jersey are building out rapidly.

One huge thing a few places get is that young people are mostly poor. If you want millennial creatives and immigrant energy, you probably need a lot of cheap housing.

Pittsburgh is doing this pretty well, but prices are starting to explode.

“I think the answer in Cincinnati is to continue to apply urbanist principles and to grow the Downtown, Over the Rhine, West End, and Uptown neighborhoods to their full potential.”

I agree that Cincinnati needs to continue to do this. The problem is that it is happening extremely slowly because the city simply doesn’t have the size to support all the vacant buildings in places like the West End any time in the near future without considerable growth in its suburbs.

There is an “us vs them” attitude between the urbanists and the suburbanites in Cincinnati. One group feels that it must succeed at the expense of the other. There was recently a nice mixed use project that fell through in West Chester and some urbanists were gloating in the comment section of the news article at West Chester’s mishap. That is the kind of development Cincinnati needs everywhere because not everybody wants to live downtown.

Even many Conservatives are questioning the auto based city model, recognizing it as an unnatural creation of state policies.

I see it as the most biggest and most destructive US example of central planning’s failure.

“Joel Kotkin Fears Conservatives Against Suburban Sprawl”

http://www.theamericanconservative.com/urbs/joel-kotkin-fears-conservatives-against-suburban-sprawl/

“Moreover, Kotkin persists in maintaining the false dichotomy that the only choices in development are post-war sprawl and soaring “concrete jungles” like New York City. In fact, widely spaced single-family lot developments curling into a never ending patchwork of disconnected cul-de-sacs are one extreme; skyscrapers are another. Conservative New Urbanists don’t embrace either extreme, but rather seek to build interconnected networks of walkable communities, with corner stores and pizza shops mixed in with a wide variety of housing, single-family homes included.

James Bacon picks up on this very distinction in criticizing a survey that purportedly debunks Millennial urban-friendliness:

The authors confuse the issue, however, by their indiscriminate use of the words “suburbs” and “suburban.” They do not differentiate between close-in suburbs where single-family dwellings have small lots and walkable streets and the far-flung “exurbs” on the metropolitan fringe where single-family dwells have large lots and rely exclusively upon automobiles.

Many New Urbanist developments could accurately be characterized as suburbs, in fact, built as they were as greenfield developments with the majority of jobs still requiring commutes. But they aren’t “suburban,” insofar as they don’t partake of sprawl.”

Nicole:

This is not actually true. In fact, the opposite is true – Houston’s per capita income growth is faster than the US average, while the Bay Area’s has been about zero since 2000, when the tech bubble burst.

And John:

Many immigrants to the US get free temporary housing. It has bars and barbed wire and guards and is pending their deportation to countries where they face risk of death.

I’m so over the way certain factions of Americans talk about immigrant energy and never once talk about the US’s abuses of refugees, its bureaucratic nightmare of a system for dealing with work migrants, and its constant violations of immigrants and foreign visitors’ civil liberties. It’s as if immigrants are a secret sauce rather than an oppressed minority.

One can make a case that Houston is doing a lot of things right (Better than the US average) in terms of absorbing and providing opportunity to a lot of people.

A great city doesn’t just attract the wealthy and middle class it moves poor people into it.

I doubt however that the massive sprawl is the key to its success or sustainable. The country needs high growth cities with reasonable urbanist qualities.

Kotkin used to say, Queens was his ideal model. If so, he needs to accept a lot more apartment style urbanism and transit.

Long term, the only winners out of the Midwest or South will be those cities that can control their suburban sprawl. Suburban sprawl is not sustainable due to the required stretching of infrastructure (roads, water, sewer, energy, goods delivery, etc.)

Even if you analyze a metro like DFW, which doubled in population over the last 50 years, you’ll find unabated suburban growth. This spells disaster in the wake of a deep, prolonged recession.

The industrial midwest “survived” the test, the South has yet to be tested.

Houston’s recent success is due to high oil prices. That’s all. Nine of its ten largest companies are in the oil industry, construed broadly (for example, Halliburton counts since it provides professional services to oil companies). The areas close to major extraction sites – Oklahoma, North Dakota, Alaska, Alberta – have had even higher income growth. The Persian Gulf states, which had declining real per capita GDPs in the 1980s and 90s, held up last decade as prices rose.

In a sense this has to do with sprawl, since sprawl generates more demand for oil, but it’s not about the sprawl in those specific regions, but rather about sprawl in the entire world. Calgary has a fair amount of sprawl but also a busy light rail network (with 300,000 weekday riders, more than Portland with half the metro area population), powered by wind power; it, too, has high and growing incomes.

@ Alon “…once talk about the US’s abuses of refugees, its bureaucratic nightmare of a system for dealing with work migrants, and its constant violations of immigrants and foreign visitors’ civil liberties.”

This would be (has been) an interesting thread. I don’t want to get into this here/now. The next time we have a dead thread I’d like to dig into this.

@Paul: “urban sprawl is not sustainable due to the required stretching of infrastructure (roads, water, sewer, energy, goods delivery, etc.)” Site Strong Towns talks about this a lot. By all logic, the statement is unassailable — until one opens one’s eyes. Our urban areas should have the best of everything — particularly infrastructure. How often is this the case? Let’s not even get into soft infrastructure (e.g. schools).

Back to the article at hand. The South’s per capital numbers are going to look bad for the immediate future. It’s hard to raise IPC when the capita part of the equation is growing. Hat’s off to Houston for being able to do this.

As has been pointed out by others the South (like the Midwest) has substantial urban minority populations mired in intergenerational poverty (and every other pathology). But the South also has a substantial rural population (of all races) that is at least as poor — if not more so). The rural part is hard to see since it’s almost hidden.

Another factor is the lack of substantial class of very-high income individuals. Birmingham has a very substantial population with incomes in the 100K-500K range. But I can’t think of a billionaire in the entire state.

Southern Auto Manufacturers Association was in town this week. I’m aware of this because the Governor gave a speech at is (The Governor always has time for the auto industry). Twenty years ago, Alabama didn’t have an auto industry. Today it has three large assembly plants (Mercedes Benz, Honda and Hyundai) and an engine building plant (Toyota). There’s also a Kia plant just across the border in Georgia — located there specifically so it could plug into the network of suppliers. These plants were lured with substantial “incentives”. I can say they were worth every penny of the “incentives”. The plants may (the point is debatable) be loss leaders. But today there are hundreds of small plants that build and supply parts. I don’t know how many businesses supply services to the plants: from truckers who haul stuff in and out of the plant engineers who design and install instrument and control equipment.

The South has been atypical in not throwing the working class under the bus accomplish other goals. This includes immigration control to certain EPA regs.

New Geography has an interesting post (which will no doubt be greeted here with derision) about how a metro resident’s standard of living is affected by (at least) two components: income and cost-of-living. With these adjustments, Southern Metros shine.

Just what is it with Kotkin’s obsession with advocating for suburban sprawl, anyway? It’s become much more to him than merely a closely-held rationalized argument–to say nothing of its quality; It’s taken on the patina of religious dogma, and he’s become a particularly overzealous evangelist for it.

Back to the discussion at hand:

Paul W.: “The industrial midwest “survived” the test, the South has yet to be tested.”

In some respects, a “test” occurred during the crash of 2007-8. Granted, it wasn’t anywhere near as severe or as long as what the Midwest suffered through during the mid-1970s through the early 1990s, but it still could still could be instructive on what could happen down the road for the Southern economy.

“Just what is it with Kotkin’s obsession with advocating for suburban sprawl, anyway? It’s become much more to him than merely a closely-held rationalized argument—to say nothing of its quality; It’s taken on the patina of religious dogma, and he’s become a particularly overzealous evangelist for it.”

The problem for Kotkin is the business model hasn’t produced results and constantly requires state support- and a new supply of true believers unwilling to look at the record.

“In some respects, a “test” occurred during the crash of 2007-8.”

The recent housing bubble hit many areas of the South very hard. Inland California and the Southwest were the epicenter, but Florida and Georgia’s suburbs took a huge hit.

The positive news is that many Southern cities are waking up and changing course.

@Alon…

I also posted per-capita income and not just GDP. However, I absolutely did include the Plains states because they are widely considered to actually BE a part of the Midwest. The Plains is more like a sub region of the Midwest, much like the Great Lakes states are.

And the South may have been growing faster by percent prior to 1980, but the actual per-capita income graph does not show that the South was catching up. The gap between the two has generally only gotten wider. Counterintuitive maybe, but it is what it is.

Regarding several comments on the south’s cost advantage in maintaining its highways, the cheapest freeway is the one that is never built. Approximately 50% of the freeways that were originally planned for the Milwaukee area were never built due to a wave of public opposition in the 1970s-80s. I’ve always viewed this as a big plus for the City of Milwaukee, in particular, the lakefront freeway that was never built.

The second cheapest freeway is the one that is torn down. The former Park East Freeway is an example of this in Milwaukee.

The third cheapest is the freeway that is rebuilt after having provided 50 years of service, and which has the possibility of serving for another 50 years when rebuilt as a consequence of being located in a slow growth city.

I asked in the first post on the subject about income. Thanks for posting the information. It looks like it the move towards parity began some 60 years ago but has been parallel since the early 90’s.

Now, how about migration from the Midwest to the south by age? Could some of the numbers be attributed to a migration of above average income retirees from the Midwest to the South? The dual residency Midwesterners I know claim the south for tax purposes.

My point is that these retirees are an income loss for the Midwest and thus a gain for the south. However, if the data you posted are correct, the parallel downward trend is actually worse for the south considering the source of the retirees income (ie no economic engine behind social security and capital gains).

The Big Ten Network, which was a first of its kind, pays each school $20 million plus and growing. Also, I don’t believe all SEC schools are accredited research institutions. Let’s be honest, they care as much about football as the B10 cares about academics and that’s not likely to change.

@ thebillshark NKY losing most of Toyota has more to do with their California operations than NKY.

And wouldn’t moving to Dallas/TX be an argument of B10 vs. B12, rather than the SEC? Take away Texas and Atlanta from the discussion and you’re talking about the Midwest minus Chicago with even less industry.

Economists: Cincinnati’s Regional Economy Outperforming Both Pittsburgh and Cleveland:

30% of the regional workforce holding a bachelor’s degree

relatively low unemployment rate which stands at 5.2%